Do All Veterans Get Death Benefits?

A veteran’s release status impacts whether their families are entitled to VA death benefits. Dishonorable discharges are disqualifying. VA regional offices determine if other less-than-honorable discharges, such as bad conduct, affect eligibility. Benefits for individual programs depend on factors such as when the veteran served, their disability status, and eligibility criteria that apply to family members.

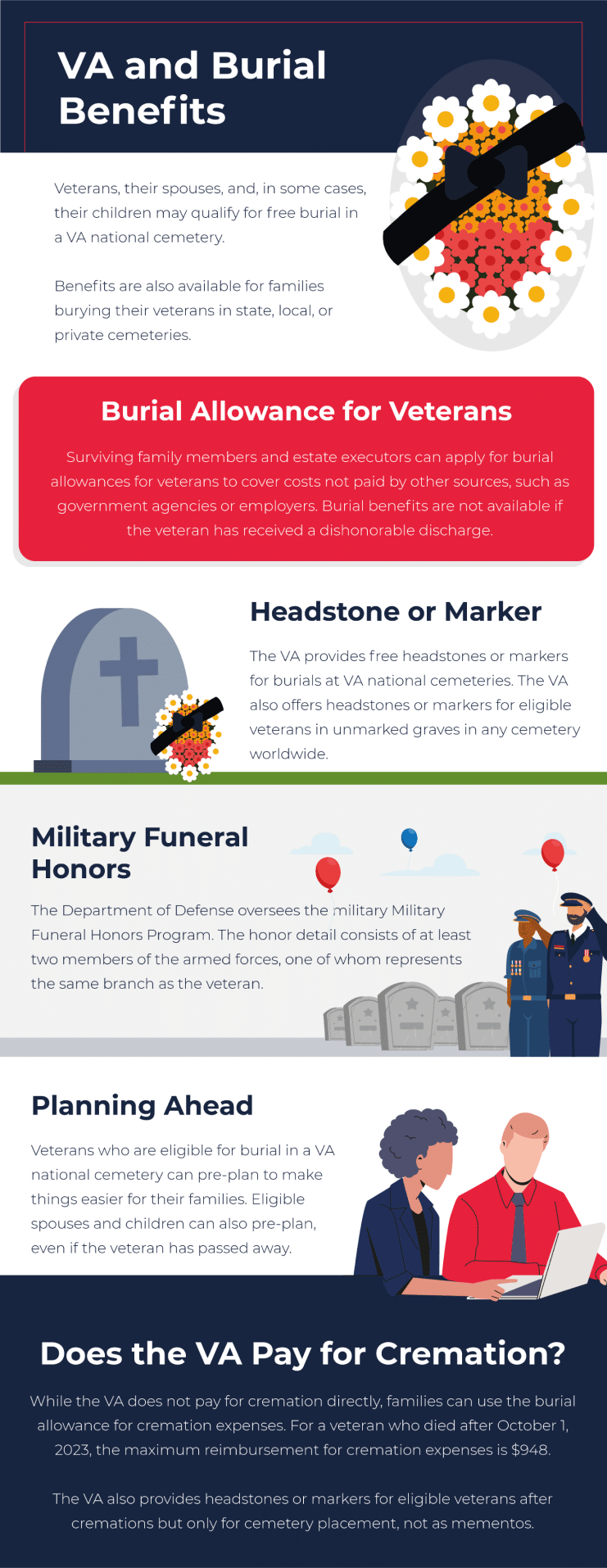

VA and Burial Benefits

Veterans, their spouses, and, in some cases, their children may qualify for free burial in a VA national cemetery. Four groups are eligible, including:

- A veteran not dishonorably discharged

- A service member who died on active duty, active duty for duty, or inactive duty for training

- The spouse of an eligible veteran

- Minor children of eligible veterans, and sometimes unmarried adult dependant children

Benefits are also available for families burying their veterans in state, local, or private cemeteries.

Burial Allowance for Veterans

Surviving family members and estate executors can apply for burial allowances for veterans to cover costs not paid by other sources, such as government agencies or employers. Burial benefits are not available if the veteran has received a dishonorable discharge. In addition, one of the following must be true:

- The death resulted from a service-connected disability.

- The death occurred while under VA care.

- The death happened during travel for VA-authorized care.

- The veteran died with a pending original or reopened VA compensation or pension claim, which was subsequently approved.

- The veteran died while receiving a VA pension.

- The veteran died while receiving full military retirement or disability pay.

As of 2024, the maximum burial allowance for service-connected deaths is $2,000 if the death occurred on or after September 11, 2001, and $1,500 if before. For non-service-connected deaths, the maximum burial allowance depends on the date of death. For example, for a veteran who died after October 1, 2023, the maximum is $948 for a burial and $948 for a plot.

There is no time limit to filing a claim for a burial allowance for service-connected deaths. However, you must file within two years of the veteran’s burial for a non-service-connected death.

The VA pays for the transportation of remains to VA national cemeteries and state or Tribal Veterans’ cemeteries. The VA also pays for or contributes to the cost of transportation of remains in specific circumstances, such as for veterans who pass away in VA nursing homes or hospitals.

You can apply for burial benefits online or by mail with VA Form 21P-530EZ.

Headstone or Marker

The VA provides free headstones or markers for burials at VA national cemeteries. The VA also offers headstones or markers for eligible veterans in unmarked graves in any cemetery worldwide. In addition, the VA provides headstones or markers for eligible veterans buried in state, local, or private cemeteries. The deceased veteran must not have received a dishonorable discharge and must meet the following criteria:

- The veteran served as an enlisted member after September 7, 1980, or as an officer after October. 16, 1981, with at least 24 months of continuous active duty, or

- The death occurred under special circumstances, such as on active duty.

Spouses and dependents buried in national, state VA, or military base cemeteries also receive government-furnished headstones or markers. The VA provides an allowance for burials in which the headstone or marker is not free. The amount depends on the date of the veteran’s death. For example, for a death after October 1, 2021, the headstone or marker allowance is $231. You can request a headstone or marker through VA Form 40-1330.

Military Funeral Honors

The Department of Defense oversees the military Military Funeral Honors Program. The honor detail consists of at least two members of the armed forces, one of whom represents the same branch as the veteran. Funeral honors include playing Taps and folding and presenting the American flag to a family member.

Any active military, National Guard member, or reservist who completed at least one enlistment or other military service obligation and whose discharge was honorable or under honorable conditions is eligible for military funeral honors.

Planning Ahead

Veterans who are eligible for burial in a VA national cemetery can pre-plan to make things easier for their families. Eligible spouses and children can also pre-plan, even if the veteran has passed away. You must choose the VA cemetery you prefer and gather documentation such as military history and discharge papers.

You can apply online or by mail with VA Form 40-10007. You must complete a separate application for each family member applying. Pre-planning does not affect your current VA benefits.

Does the VA Pay for Cremation?

While the VA does not pay for cremation directly, families can use the burial allowance for cremation expenses. For a veteran who died after October 1, 2023, the maximum reimbursement for cremation expenses is $948.

The VA also provides headstones or markers for eligible veterans after cremations but only for cemetery placement, not as mementos.

Other Death Benefits Available for Veteran Families

Several benefits are available to surviving spouses, children, and sometimes parents of deceased veterans. Eligibility varies across programs.

Dependency and Indemnity Compensation

The Dependency and Indemnity Compensation program, or DIC, pays monthly benefits to surviving spouses, children, or parents of veterans who passed away after January 1, 1957. The program provides benefits to family members of veterans who:

- Died on active duty or active or inactive training duty

- Died due to a service-connected disability or a condition worsened by a service-connected disability

- Were considered totally disabled due to a service-connected disability, in some cases

- Were released under conditions other than dishonorable, and their death did result from their misconduct

Your DIC rate depends on the date of the veteran’s death, your relationship with the veteran, your number of dependents, and your disability needs. For example, as of 2024, surviving spouses of veterans who died on or after January 1, 1993, receive $1,612.75 monthly. If the spouse has a disability, they receive another $399.54 monthly.

Survivors Pension

The VA Survivors Pension program provides monthly payments to eligible surviving spouses and unmarried dependent children of wartime veterans. Eligibility requirements include:

- Active duty beginning on or before September 7, 1980, with at least 90 days of active service and at least one day during a covered wartime period.

- Active duty began after September 7, 1980, and service lasted at least 24 months, with at least one day during a covered wartime period.

- An officer who started active duty after October 16, 1981, and hadn't previously served on active duty for at least 24 months.

- Family members' yearly income and net worth must be below congressionally set standards. As of 2024, that is $155,356.

Children under 18 are also eligible, as are those under 23 who are attending a VA-approved school or are unable to care for themselves due to a disability that developed before age 18.

Your pension rate depends on whether you have dependants and whether you qualify for other VA benefits. In 2024, the maximum annual pension rate for qualified children is $2,831. For spouses, the maximum rate varies between $11,102 and $21,807.

Civilian Health and Medical Program of the Department of Veterans Affairs

The Civilian Health and Medical Program of the Department of Veterans Affairs, or CHAMPVA, is a health insurance cost-sharing program for families not eligible for TRICARE insurance. Spouses and children are eligible for CHAMPVA benefits if veterans pass away in specific circumstances, including:

- With a VA-rated service-related disability

- With a VA rating of permanently and totally disabled from a service-connected disability

- In the line of duty, not due to misconduct

In most cases, CHAMPVA’s allowable payment amounts equal Medicare and TRICARE rates. The annual deductible is $50 per beneficiary or $100 per family, and the cost-share rate is 25 percent, up to $3,000.

Home Loan Guaranty

The VA offers home loans and refinancing for surviving spouses. Eligibility requirements include:

- The surviving spouse has not remarried.

- The service member passed away due to a service-related disability or in the line of duty.

- The loan or refinancing is for a primary residence.

Some benefits of the VA Home Loan Guaranty program include zero down payments, no private mortgage insurance, and competitive interest rates.

Dependents' Educational Assistance

The Dependents’ Educational Assistance program, also called DEA or Chapter 35, is available as a veteran death benefit for children and spouses who need education and training. The program is available if the service member has died in the line of duty or due to a service-connected disability. To qualify, you must be 18 or older and have completed high school.

The amount you can receive through Chapter 35 depends on the type of education or training you pursue. Some examples include the following:

- Full-time at a college or university: $1,488 per month

- Full-time enrollment in a trade or vocational school: $1,488 per month

- Apprenticeships and on-the-job training: $945 for months one through six, with payments decreasing with further time

- Correspondence training: 55 percent of the established costs. Only spouses are eligible.

- Restorative training: $1,488 for full-time. Only children are eligible.

Chapter 35 also pays for part-time training and education.

VA Life Insurance

Spouses covered under Family Servicemembers’ Group Life Insurance can convert the plan to private coverage following their spouses’ deaths. You must do so within 120 days and choose from a list of participating companies. Your coverage under your new policy depends on your previous coverage.