VA Funding Fee Explained

The VA funding fee is a one-time charge for most VA home loans. Its purpose is to help sustain the VA loan program and ensure future veterans and service members can continue to benefit from it by reducing the cost to taxpayers.

Disclaimer: Paid advertising. We receive advertising fees from Novus Home Mortgage.

While the VA loan program offers significant advantages, such as no down payment requirement and no private mortgage insurance, the funding fee is an essential cost for borrowers to factor into their homebuying plans. Veterans should also be aware that some may qualify for an exemption, such as those with a service-connected disability, which can make the loan even more affordable.

- The VA funding fee is a one-time cost most borrowers must pay at closing on a VA home loan.

- The funding fee helps sustain the VA loan program, but it can be financed as part of the loan.

- Many veterans, especially those with service-connected disabilities, are exempt.

- Understanding the fee structure can save thousands of dollars.

What Is the VA Funding Fee?

The VA funding fee is a charge that applies to most VA home loans. This is a one-time fee applied to both purchase and refinance transactions. It exists to maintain the sustainability of the VA loan program. It is important to note that this fee is separate from closing costs.

What really changes the funding fee rates are factors like first-time vs subsequent use, down payment amount, loan type, and whether you qualify for an exemption.

Jodi Ulrich

Mortgage - NMLS#9456

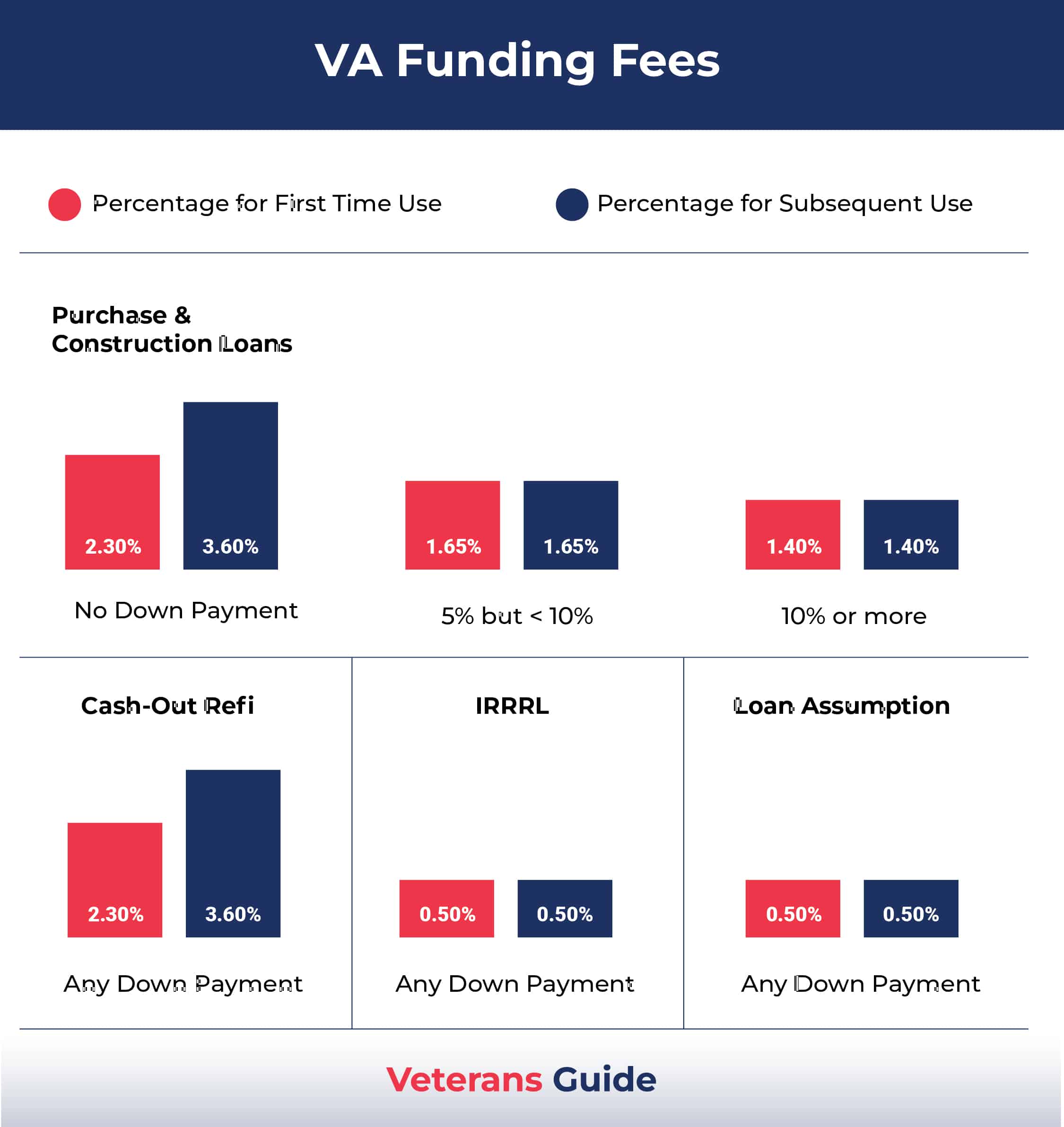

VA Funding Fee Rates for 2025

When considering a mortgage, it is essential to understand the distinction between first-use and subsequent-use loans. First-time use applies the first time you use your VA home loan benefit to purchase, build, or refinance a home. First-use loans qualify for a lower funding fee rate. Meanwhile, subsequent-use loans apply when you have already used your VA loan entitlement once before for a purchase or construction loan and are using it again.

The funding fee is generally higher on no-down-payment loans. There are some exceptions, such as when you make a down payment of at least 5%, in which case the funding fee returns to the same rate as for first-time use.

If you paid off your prior VA loan and your entitlement was fully restored, it is still considered a subsequent use for funding fee purposes, unless the loan was only used for certain types of manufactured homes.

Need Help? Use Our Free Funding Fee Calculator

Who Is Exempt From the VA Funding Fee?

The following individuals are exempt from the VA funding fee:

- Disabled veterans receiving VA disability compensation

- Surviving spouses of veterans who died in service or from service-related disabilities

- Purple Heart recipients, for loans closed while on active duty

Veterans can prove they are exempt from the VA funding fee by having their Certificate of Eligibility reflect the exemption status. The COE, which lenders pull directly from the VA, will indicate if the borrower has a qualifying service-connected disability, receives VA disability compensation, or otherwise meets the criteria.

To avoid paying the fee at closing, veterans should ensure their disability claim has already been decided and recorded with the VA before the lender requests the COE. If the exemption is still pending at closing, the veteran may need to pay the fee upfront and then apply for a refund later.

VA Funding Fee Refunds

Veterans may be eligible for a refund if a disability claim is approved after loan closing. Below is a comprehensive list of steps for doing so:

- Confirm Eligibility: Check your updated VA disability award letter or have your lender pull a new Certificate of Eligibility to verify the exemption status.

- Contact Your Lender: If you are still working with the lender, they can initiate the refund request directly through the VA’s WebLGY system.

- Submit a Refund Request to the VA: If the lender is unable to process your request, submit it directly to the VA. This can be done online through your VA.gov account or by mail to the VA Regional Loan Center that handles your state.

- Provide Documentation: You may need to include a Closing Disclosure or settlement statement as proof of payment for the funding fee, as well as a VA award letter or updated COE showing exemption.

- VA Review and Approval: The VA will verify your exemption status and confirm that the funding fee amount has been paid.

- Refund Issued: If you financed the fee into your loan, the VA will send the refund to your mortgage servicer to apply toward the loan balance. However, if you paid the closing costs in cash, the VA will send the refund directly to you.

The typical refund takes 30 to 60 days once the VA receives all documentation. If entitlement or disability records are still being updated, processing may take longer.

Honoring your health with a head start: The VA funding fee waiver is our way of saying ‘thank you’ for your sacrifice.

Jodi Ulrich

Mortgage - NMLS#9456

How To Pay the VA Funding Fee

There are two options for paying the VA funding fee: upfront at closing or financing it into the loan balance.

Pay Upfront at Closing

The borrower pays the full funding fee in cash as part of their closing costs. This prevents the fee from being added to the loan balance.

Finance Into the Loan Balance

Rather than paying the funding fee at closing, you can roll it into the total loan amount. This increases the loan principal, meaning you will pay interest on the funding fee over time. Financing typically leads to lower upfront costs, greater accessibility, and preserves your savings. However, you can usually expect higher monthly payments, more interest over time, and reduced equity at the time of closing.

VA Funding Fee vs Other Loan Fees

The VA funding fee is a one-time fee, or a percentage of the loan amount, charged on most VA loans to help sustain the program. It is paid at closing, either upfront or financed as part of the loan. However, veterans with service-connected disabilities, some surviving spouses, and Purple Heart recipients do not pay it.

FHA Upfront Mortgage Insurance Premium

In contrast, the FHA Upfront Mortgage Insurance Premium, or UFMIP, is a one-time mortgage insurance premium required on all FHA loans. It is also paid at closing, either upfront or rolled into the loan.

As of 2025, the Flat rate is 1.75% of the loan amount, regardless of down payment. There are ongoing costs as borrowers also pay annual or monthly FHA MIP at 0.15%–0.75%, depending on loan term, LTV, and loan size. Unlike the VA funding fee, the UFMIP has no standard exemptions and applies to nearly all FHA borrowers.

Conventional Loans – Private Mortgage Insurance

Private mortgage insurance, or PMI, protects the lender in the event of borrower default. It is typically required for borrowers who put down less than 20% of the purchase price. It is paid monthly as part of the mortgage payment. Occasionally, a one-time upfront premium option is available; however, monthly payments are more common.

In 2025, the annual rate is approximately 0.5% to 2%, depending on the credit score, loan amount, and down payment. Costs are ongoing, but PMI is no longer required once the borrower reaches 20% equity, either by payments or appreciation. It is not required for borrowers who put down 20% or more of the purchase price.

While there is more than one loan option available, VA loans still typically cost less overall.

If you have a service-connected disability, your path to homeownership just got thousands of dollars cheaper.

Jodi Ulrich

Mortgage - NMLS#9456

Tips To Reduce or Avoid the VA Funding Fee

You can take proactive steps to reduce or avoid the VA funding fee altogether, such as:

- Make a down payment of 5% or more to reduce the fee

- Verify exemption eligibility early

- Consider whether an IRRRL refinance might avoid a higher fee

Our team can review the details of your situation and any existing claims to determine your options for a loan.

What's Next? Speak With a VA-Approved Lender

Understanding the VA funding fee and your potential exemption is essential for maximizing your VA home loan benefits. Confirming your exemption status before closing and collaborating with a VA-approved lender can help you avoid extra costs, safeguard your benefits, and simplify the homebuying process.

Taking these proactive measures ensures that you fully benefit from the VA loan program, such as no down payment and no PMI, and provides peace of mind, knowing you are making the best financial decision for your future.

Jodi has over 22 years in home lending, specializes in VA loans, and helping military families achieve homeownership. As a top loan officer at Novus, he’s closed over 9,000 loans across 40 states. Jodi is dedicated to empowering veterans with VA benefits, fostering long-term financial success, and offering personalized service.